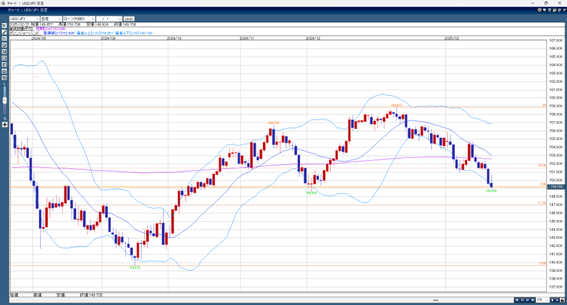

This week, a ‘death cross’ is expected, where the 21-day moving average (21MA) will cross below the 200-day moving average (200MA). This suggests that the USD/JPY may drop further.

Last week, USD/JPY started below the 200MA. Japan’s GDP was weaker than expected, and a comment from BOJ’s Takata caused the yen to strengthen, pushing USD/JPY down to the lower 149 yen range. Later, Japan’s CPI was stronger than expected, leading to more yen buying, but comments from BOJ Governor Ueda caused a rebound, sending USD/JPY back to the mid-150 yen range. However, the U.S. PMI data was weaker than expected, causing U.S. stocks to fall sharply and USD/JPY to drop again, briefly falling below 149 yen, showing a trend toward yen strength.

This week, the yen is expected to remain strong, but traders should be careful of position adjustments ahead of key data releases, including Tokyo’s January CPI and the U.S. PCE Deflator. Tokyo’s CPI is expected to slow for the first time in four months, but expectations of an early BOJ rate hike remain unchanged. Once adjustments are complete, yen buying may continue. The U.S. PCE Deflator is also expected to slow, which could add pressure on the dollar.

With the expected death cross between the 200MA and 21MA, there is a risk of further declines.

Today’s USD/JPY Forecast Range: 149.80 – 148.70

This Week’s USD/JPY Forecast Range: 151.50 – 147.00

Note: This information does not guarantee profits. Please make your own trading decisions.