The U.S. Consumer Price Index (CPI) released the day before was higher than expected, causing interest rates to rise. As a result, gold prices dropped for the first time in a while.

However, yesterday, U.S. long-term interest rates rose again. The January Producer Price Index (PPI) was lower than expected, and the Personal Consumption Expenditures (PCE) price index also showed weak results. This caused interest rates to fall, and gold prices started to rise again.

Still, President Trump signed a tariff policy, but reports say it will take a few months to be enforced. Because of this, market concerns have eased, limiting gold’s price increase.

In addition, talks between the U.S. and Russia about ending the Ukraine war are also preventing gold prices from rising further.

However, the situations in Ukraine and Israel are not likely to be resolved soon. Since the tariff enforcement is also delayed, risks remain. Because of this, the upward trend in gold prices is expected to continue.

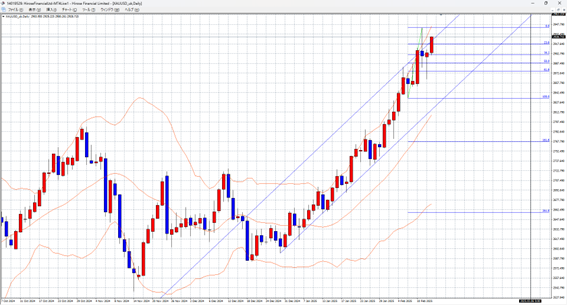

Gold-Dollar Expected Price Range: 2945 – 2900

Note: The information above does not guarantee profits. Please make your own decisions when trading.