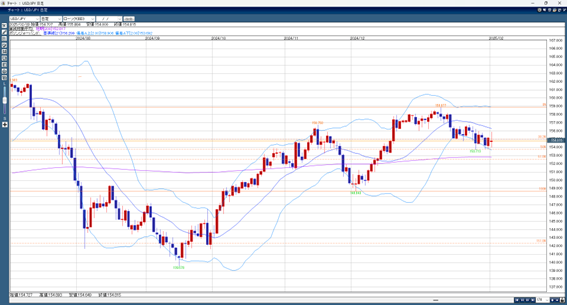

At the beginning of the week, the U.S. dollar rose to 155.88 yen after the Trump administration decided to impose a 25% tariff on Mexico and Canada. However, when Japan’s stock market fell by over 1,000 points, investors bought yen for safety, pushing the dollar down. In Western markets, stock prices also dropped, causing more yen buying and bringing the dollar down to 154.00 yen. Later, news that the Mexico tariff would be delayed for one month changed market sentiment, and the dollar rose again to 155.01 yen.

Trump’s tariffs are a negotiation tool, and he may change them depending on the situation. This will keep the market unstable. Because of high volatility, investors may continue to buy yen for safety, limiting the dollar’s rise.

USD/JPY Expected Range: 155.20 – 153.80

Please note: The above information does not guarantee any profit. Please make your own decisions when trading.