Following the speech by Governor Ueda the day before, reports yesterday suggested that the Bank of Japan might raise interest rates in next week’s meeting. This caused the yen to strengthen across the board. Meanwhile, concerns about inflation reigniting in the U.S. eased due to a lower CPI (Consumer Price Index), making it hard for the dollar to rise. In Tokyo trading, USD/JPY fell to 155.21 yen. Although it recovered to the 156 yen range later, it dropped again to 155.11 yen in the New York market.

Waller, a member of the Federal Reserve Board, hinted at 3-4 rate cuts this year, which lowered U.S. long-term interest rates and led to stronger selling of the dollar.

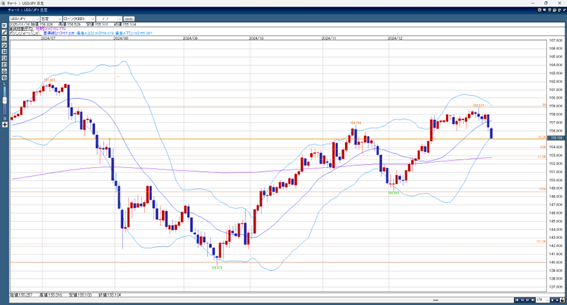

For now, the level just below 155 yen seems to act as strong support, forming a double bottom. There may be buying at the end of the week. However, since the trend of selling dollars and buying yen has just started, if USD/JPY clearly breaks below 155 yen, the next noticeable support is likely around the high 153 yen range, where the retracement level lies.

USD/JPY Expected Range: 156.00 yen – 153.80 yen

Note: The above information does not guarantee profits. Please make your own decisions when trading.