This week, the Bank of Japan (BOJ) meeting is expected to hold off on cutting interest rates, while the FOMC (Federal Reserve) meeting is expected to reduce rates by 0.25%. The market has already factored in these expectations.

The focus will be on comments from BOJ Governor Ueda and the “”dot plot”” from the FOMC, which shows how many rate cuts are expected next year.

If the BOJ raises interest rates at this meeting or hints at the possibility of a rate hike in the next meeting, the yen could strengthen as investors buy it back.

For the FOMC meeting, the market already expects two rate cuts next year. If the Fed suggests more rate cuts than this, the dollar could weaken as investors sell it.

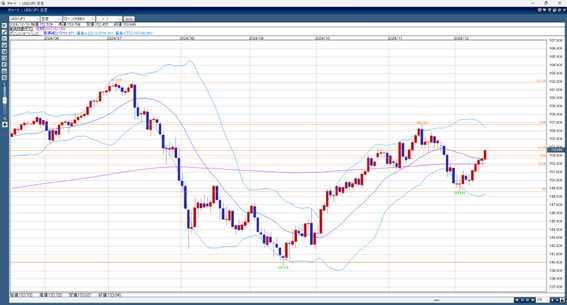

Also, the 21-day moving average is close to crossing below the 200-day moving average.

As a result, there is a higher risk of the dollar-yen moving lower after this week’s meetings.

Today’s dollar-yen forecast range: 154.00–153.20

This week’s dollar-yen forecast range: 154.80–151.00

Note: The above information does not guarantee profits. Please make your own decisions when trading.