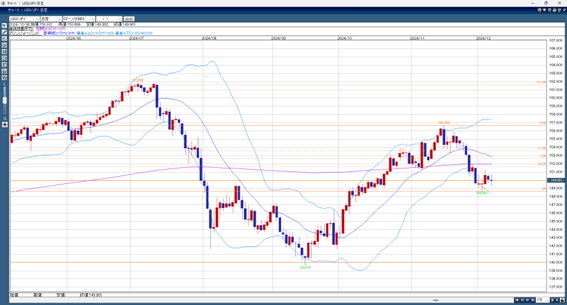

Last week, the movement of the USD/JPY exchange rate was limited to a narrow range of about 2.6 yen. The tug-of-war between the dollar and yen has made it hard to identify a clear direction.

At next week’s U.S.-Japan monetary policy meetings, expectations remain for the Federal Reserve to lower interest rates and the Bank of Japan to raise them. However, the market does not fully expect these changes to happen yet.

This week, the U.S. Consumer Price Index (CPI) for November will be released. If it shows the expected increase from the previous month, this may reduce expectations for a Federal Reserve interest rate cut, leading to dollar buying. However, as long as there are lingering expectations for a Fed rate cut, the upside for the dollar may be limited.

On the other hand, there is growing speculation that the Bank of Japan may not raise interest rates, which leaves room for yen buying. Still, until next week’s U.S.-Japan policy meetings, USD/JPY is expected to stay within a narrow range.

Today’s USD/JPY Forecast Range: 150.40–149.60

This Week’s USD/JPY Forecast Range: 151.70–148.70

Note: The above content does not guarantee any profits. Please make your own decisions when trading.