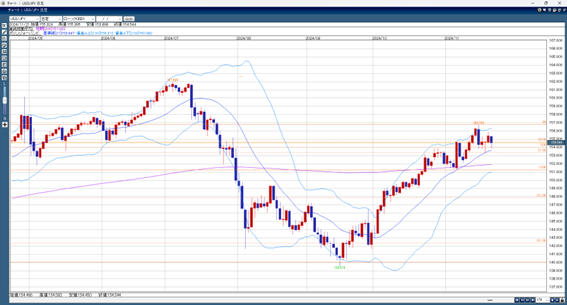

After the Tokyo market closed, BOJ Governor Ueda suggested the possibility of a rate hike in the December meeting. Meanwhile, NY Federal Reserve President Williams commented that interest rates might decrease further. These developments caused USD/JPY to drop to the mid-154 yen range.

Later, reports about Russia launching an intercontinental ballistic missile (ICBM) led to a risk-off movement, causing more yen buying and pushing USD/JPY down to 154.09 yen. Although the dollar recovered somewhat, weak November Philly Fed data released during NY trading hours caused USD/JPY to fall further to 153.90 yen. On the other hand, the Dow saw significant gains, helping USD/JPY rebound to close around the mid-154 yen level.

Geopolitical risks often cause temporary market movements, but this time they may last longer. Additionally, expectations for a BOJ rate hike in December are rising, while the FOMC is expected to lean toward rate cuts. This could limit the dollar’s upward movement against the yen. However, market expectations for a stronger dollar under the Trump administration remain.

Today, Eurozone and US PMI data will be announced. Since this is the end of the week, risk-off sentiment may increase, and USD/JPY is expected to have limited upward movement overall.

USD/JPY Expected Range: 155.20 yen – 153.50 yen

Please note that the above information does not guarantee profits. Make your trading decisions at your own risk.