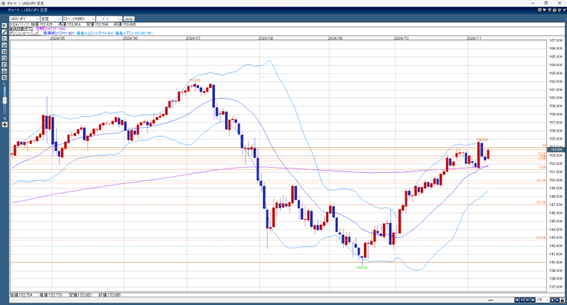

On Monday, in the Tokyo market, the USD/JPY rate increased as dollar buying led the way. This was partly because the Nikkei average went up and Japan’s September trade deficit was larger than expected, causing the yen to weaken overall. In the European market, the dollar continued to be bought, pushing the USD/JPY rate up to 153.95 yen. The market still feels the effects of “Trump trade,” making it easy for the dollar to rise.

Additionally, the 21-day moving average crossed above the 200-day moving average from below, encouraging more dollar buying and creating momentum for USD/JPY to possibly reach 155 yen again. However, with the U.S. CPI report due tomorrow, there may be some short-term selling to adjust long dollar positions.

USD/JPY Forecast Range: 154.00–153.00 yen

Note: The information above does not guarantee profit. Please make your own decisions when trading.