At the ECB (European Central Bank) meeting held yesterday, as expected, the policy interest rate was cut by 0.25%, bringing it to 3.4%. In the statement, it was mentioned that ‘inflation is slowing down steadily.’ ECB President Lagarde also said, ‘The risk of inflation is probably on the downside,’ and ‘the economy is a bit weaker than expected, with growth risks also on the downside.’ This suggested the possibility of another rate cut in the next meeting, leading to more selling of the euro.

Additionally, strong data on U.S. retail sales and employment supported the buying of the U.S. dollar, causing the euro to fall to 1.0811. While the U.S. Federal Reserve (FRB) is slowing down its rate cuts, the ECB shows no signs of slowing down its rate cuts.

With the U.S. economy remaining strong and the European economy looking weak in comparison, the selling of the euro seems to be ongoing.

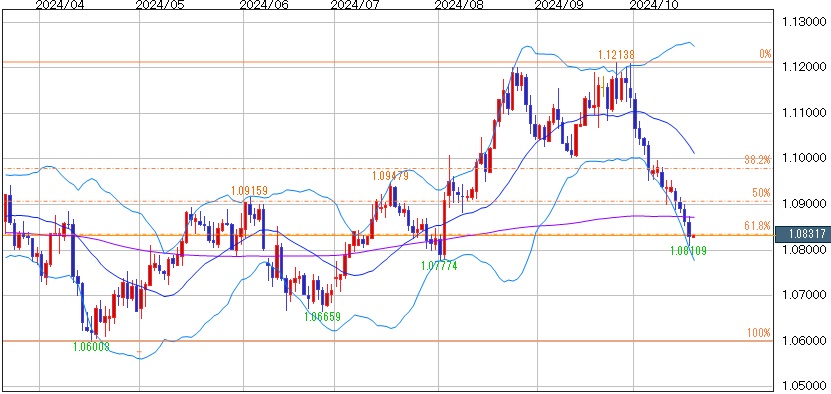

There is a view that the euro might stop falling near the 1.0778 mark, which is around the lower boundary of the Bollinger Band, reached on August 1.

EUR/USD forecast range: 1.0850 to 1.0780

Please note that the above information does not guarantee profits, so make your own decisions when trading.