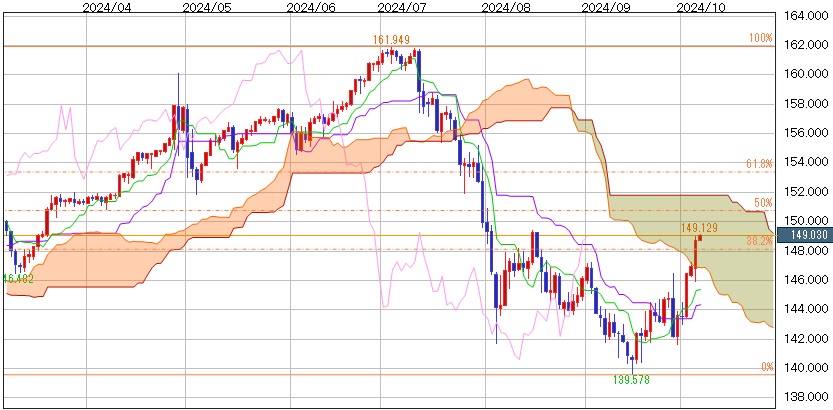

The U.S. dollar rose strongly across the board after a surprise U.S. jobs report was released last weekend. The number of people employed grew the most in six months, and the unemployment rate fell. Wages also increased more than expected, which made the market think the U.S. Federal Reserve will not cut interest rates as much at its next meeting. On the other hand, Prime Minister Ishiba made comments against raising interest rates in Japan, which lowered expectations of the Bank of Japan raising rates soon. As both the U.S. and Japan adjust their policies, the dollar-yen rate reached 149 yen last weekend. Since the dollar has entered the Ichimoku cloud (a technical indicator), the upward trend in buying may continue this week. Although the 150 yen level is important, the U.S. Consumer Price Index (CPI) report for September, to be released this week, could push the dollar higher if the data is strong.

However, since there is no change in the U.S. keeping rates high and Japan keeping rates low, the dollar-yen may eventually return to a downward trend after this adjustment period.

Today’s expected range for the dollar-yen is between 149.20 yen and 148.20 yen.

The expected range for this week is between 150.80 yen (50% chance) and 146.00 yen.

Please note that this information does not guarantee any profits, so make your own decisions when trading.