Last weekend, the U.S. and Russia held a summit, but no peace deal was reached. This means geopolitical risks are still here, and one reason for selling gold has now disappeared.

This week, the world is watching the speech of Federal Reserve Chairman Powell at Jackson Hole. Until now, Powell has been careful about cutting interest rates, because of the strong job market and unclear effects of tariffs. But now, the job market looks weaker, and worries about high inflation from tariffs have become smaller. So, there is a good chance Powell may show a more positive view on cutting rates. This is good news for gold, which does not pay interest.

However, if the market thinks Powell is lowering rates because of government pressure, people may worry about the central bank’s independence. In that case, the U.S. dollar could fall. Either way, both situations can lead to buying gold.

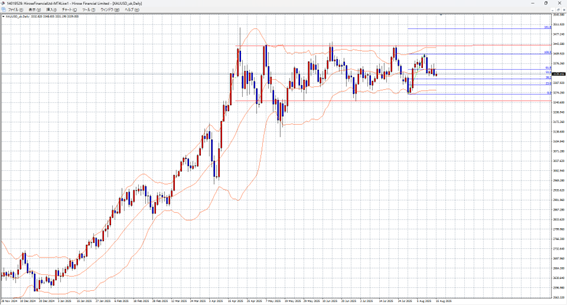

Still, since markets have already expected rate cuts, gold’s rise may be limited. It is better to sell near the top of the range, around 3440.

This week’s forecast for Gold/USD range: 3,300 – 3,400 USD

Note: This is not a guarantee of profit. Please make your own decisions when trading.