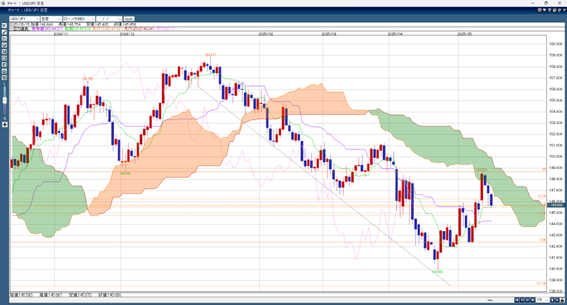

The Japanese yen continued to rise yesterday. This happened because there was news that U.S. and South Korean officials talked about currency issues. People now think that Japan and the U.S. might also talk about stopping the yen from getting weaker. Also, Japan’s stock market went down, which made people buy more yen. As a result, the USD/JPY dropped from the upper 146 yen level to 145.48 yen.

Later, the dollar went up a little, but not enough to change the overall trend. This was the third day in a row that USD/JPY fell. Earlier gains in the dollar caused by progress in U.S.-UK and U.S.-China talks are now being adjusted.

Also, U.S. PPI (Producer Price Index) was lower than expected, which made long-term U.S. interest rates go down. This added more pressure on the dollar. Because of continued uncertainty in the market, traders are being careful, and price movements are limited. This situation is expected to continue today.

Expected USD/JPY Range: 144.80 – 146.20

Note: The information above does not guarantee profits. Please make your own decisions when trading.