During the previous day, the FOMC meeting showed a aggressive stance, leading to a rise in long-term U.S. interest rates and causing gold prices to fall sharply. As a result, some buying back followed, pushing the price back up to around 2626.

However, yesterday’s release of U.S. GDP data for July-September was revised upward, and existing home sales far exceeded expectations. This caused interest rates to rise further, leading to stronger selling pressure on gold, which fell back to around 2587.

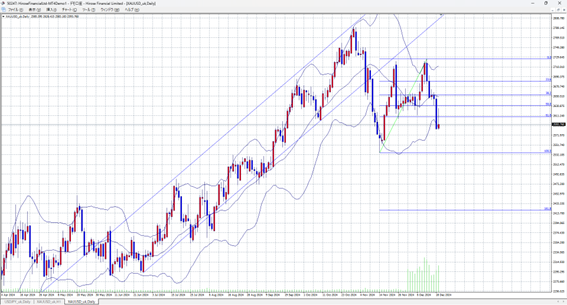

Gold did not reach the double top neckline of 2635 before declining again, confirming resistance at higher levels. If today’s PCE deflator (inflation data) released during New York trading time shows stronger-than-expected results, U.S. long-term interest rates may rise further, and gold prices could drop even lower.

Gold-Dollar Predicted Range: 2610–2560

Note: The above information does not guarantee profits. Make your own decisions when trading.