Yesterday, the U.S. July Producer Price Index (PPI) was higher than expected. Because of this, the chance of an early U.S. interest rate cut became lower. When U.S. long-term interest rates went up, gold prices fell. Last month’s weak U.S. jobs report and stronger pressure from the U.S. government for a rate cut had supported gold before, so this reaction was the opposite. Today, the U.S. July retail sales data will be released. If the result is also stronger than expected, gold prices may fall more. However, many people still believe the Federal Reserve (FRB) will cut rates later this year, so the price drop may be temporary.

Another focus is the U.S.–Russia leaders meeting today. If it leads to stopping the war in Ukraine, gold prices may fall. But the market does not have high expectations, and most people think a peace agreement will still take time. Still, before the meeting, hopes for peace may cause gold prices to drop, so be careful.

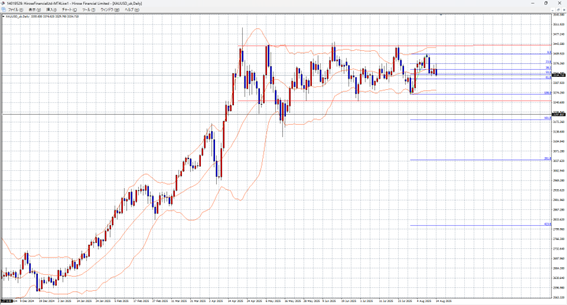

Gold–Dollar expected range: 3,320 (61.8%) – 3,380

Note: This information does not guarantee profits. Please make your own decisions when trading.