Yesterday during New York trading hours, the U.S. PCE Deflator (a price index showing inflation) came out stronger than expected. This made the U.S. dollar go up even more. Gold had fallen sharply the day before because the U.S. central bank (FOMC) showed they are careful about lowering interest rates. After that drop, gold bounced back up to 3314. But now, it seems harder for gold to go higher.

Today, the U.S. employment report will be released. Many expect it to be weaker than last month, especially for the unemployment rate. However, if the report is stronger than expected, gold may fall again.

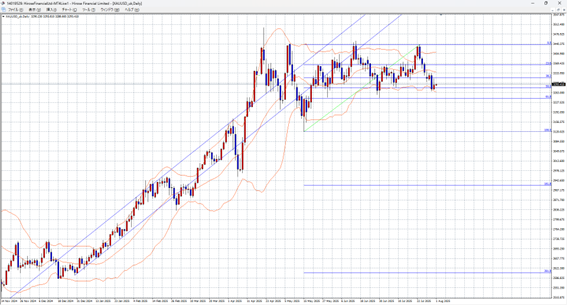

The support level (where gold may stop falling) is around 3240. This level is important because gold stopped falling at this point at the end of May and June.

Gold and U.S. Dollar Price Range Forecast: 3,240 – 3,310 USD

Note: This information does not guarantee profits. Please make your own decisions when trading.