At the beginning of the week, in the European market, U.S. long-term interest rates started to go down. Because gold does not give interest, it often goes up when interest rates go down. This made the price of gold rise.

Also, U.S. Treasury Secretary Bessent said, “If inflation goes down, interest rates should be lowered.” This supported the price of gold too.

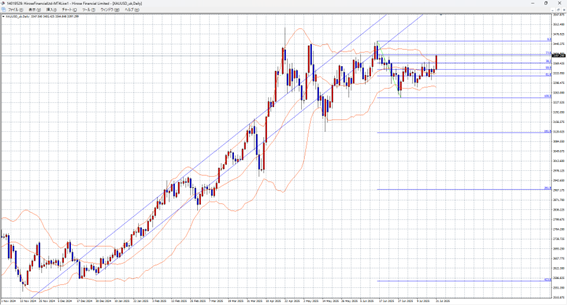

Later, in New York trading hours, a report about the U.S. economy showed weaker results than expected. This made the U.S. dollar go down and pushed the price of gold up. As a result, gold broke above the top line of a triangle chart pattern and went up to 3401.

Today, Treasury Secretary Bessent will attend a meeting with the U.S. central bank. She might again ask for interest rate cuts. Also, there is still uncertainty about tariffs. These things are likely to keep gold strong.

Expected gold price range (against USD): 3,360 – 3,430

Note: This information does not guarantee profits. Please make your own decisions when trading.