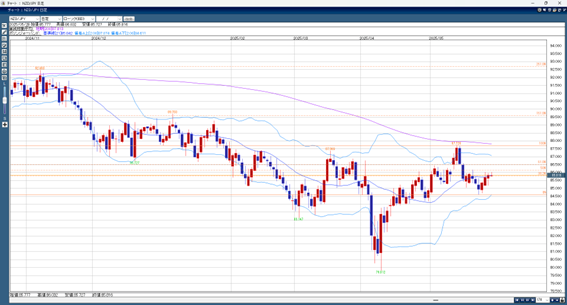

In yesterday’s Tokyo market, the NZ dollar fell to 85.19 yen after Bank of Japan Governor Ueda said interest rate hikes would continue. Later, when the Ministry of Finance talked about changing its bond plan, the yen weakened, and the NZ dollar went back up to 85.96 yen at the end of the day.

Today, the Reserve Bank of New Zealand (RBNZ) is expected to cut interest rates for the sixth time in a row. In the last meeting, they said there was still room for more cuts if needed, which led to today’s expected cut. However, the size of the rate cuts is getting smaller, and there may not be much room left for more cuts.

If today’s statement removes the words about having room for more cuts, the NZ dollar might go up more. But if people still expect more rate cuts later this year, the yen could stay strong, so selling the NZ dollar when it goes up might be a good idea.

NZD/JPY Expected Range: 85.50 yen – 86.50 yen

Note: This information does not guarantee any profits. Please make your own decisions when trading.