After the Tokyo market closed, news came out that the U.S. and South Korea held currency talks on the 5th of this month. This led some people to think that Japan and the U.S. might also talk about stopping the Japanese yen from getting too weak. Because of this, the U.S. dollar fell to 145.60 yen.

Later, the dollar slowly went back up, helped by a report during New York trading hours saying the U.S. government is not trying to make the dollar weaker as part of trade talks. This pushed the dollar back to the 147 yen range. However, worries about the weak yen still remain, so the dollar could not go much higher and ended the day in a weak position.

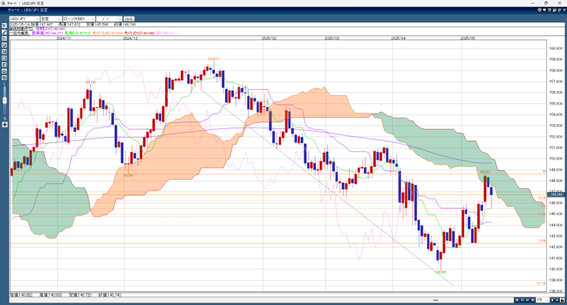

The buying power for the dollar from the U.S.-China trade talks is also getting weaker. The dollar’s rise is slowing down, following the Ichimoku cloud trend. But the recent low around 145.50 yen is seen as strong support because it matches the 50% retracement level and the Ichimoku turning line.

Expected Price Range for USD/JPY: 145.50 yen – 147.10 yen

Note: The above content does not guarantee profits. Please make your own decisions when trading.