Gold prices went up early in the week, especially while the Tokyo market was closed. This happened because President Trump said he would put a 100% tariff (extra tax) on movies made outside the U.S. As a result, the U.S. dollar became weaker, and people started buying gold.

Later in the European market, the U.S. dollar kept falling, and gold prices continued to rise.

During the New York market session, the U.S. released an economic report (the ISM Non-Manufacturing Index), which was better than people expected. Because of that, some investors bought U.S. dollars, and some people sold gold to take profits. But overall, the trend of selling the U.S. dollar didn’t change, and gold closed at a high price. Gold prices mostly went up in a straight line.

Last week, gold prices were falling, but this week they finally started going up again. However, there’s a chance that people may expect positive talks about tariffs between the U.S., China, and other countries. If that happens, gold prices might fall again after short sellers finish buying back their positions.

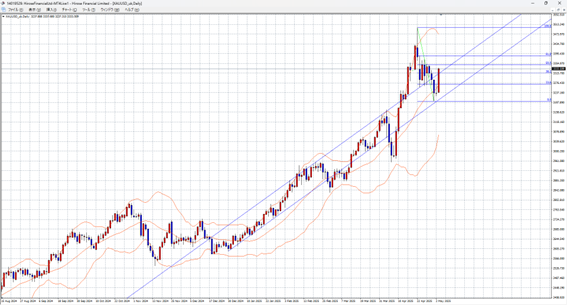

Still, since gold stopped falling near the lower line of an upward price channel last week, this drop may only be temporary. The long-term upward trend could still continue.

Expected Range for Gold/US Dollar: 3,300 – 3,350

Note: The information above is not a guarantee of profit. Please make your own trading decisions.