Last week, fears in the market became smaller. This was because the news said Federal Reserve Chairman Powell would not be removed, and there were signs of progress in the U.S.-China trade talks, even though there were different opinions.

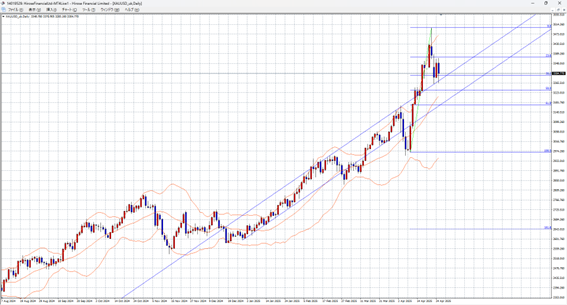

Gold reached a new record high of 3500 dollars but then dropped as many people sold their gold to take profits.

However, U.S. President Trump is still putting pressure on Chairman Powell to lower interest rates. Also, the U.S.-China trade talks are not finished yet. Because of Trump’s changing statements, the market still feels uneasy.

This week, important economic data will be released, such as U.S. employment numbers, GDP, and the ISM survey. Also, markets in Europe and the U.S. will have a holiday (May Day).

If the economic results make people worry more about a slowdown in the U.S. economy, gold prices may rise again and test new highs.

The market will continue to focus on Trump’s tariffs.

Because trading volume may be low due to the holiday, price movements could be rough.

However, gold is seen as a safe asset, and we think people will continue to buy gold during uncertain times.

Expected Gold/Dollar Trading Range This Week: 3230-3500

Note: The above is not a guarantee of profits. Please make your own decisions when trading.