Recently, the U.S. stock market, government bonds, and the U.S. dollar all dropped at the same time due to concerns about new tariffs from Trump. This made many people buy gold because it is considered a safe asset.

However, at the end of last week, the market was closed for the Easter holiday, so trading slowed down.

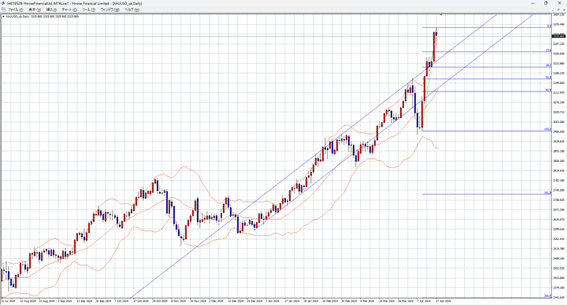

If we look at the daily candlestick chart, we can see a candle with a long lower shadow at the top price area. This might mean that gold has reached a short-term peak.

If the negotiations between countries go well during the 90-day period when the new tariffs are paused, the market may feel more stable. In that case, some people might sell gold to take profits.

But since the tariff issue is not easy to solve quickly, we still believe that the overall trend for gold will continue to go up.

Gold/US Dollar Forecast Range for This Week: 3200 – 3360

Note: This information is not a guarantee of profit. Please make your own decisions when trading.