After the release of strong U.S. manufacturing data, some investors believed the U.S. economy remains robust, which supported the dollar. However, comments from Federal Reserve officials about potential interest rate cuts led to a decrease in U.S. long-term interest rates. Lower interest rates can weaken the dollar, prompting some traders to sell dollars and buy yen.

At the same time, Japan reported strong machinery orders, indicating continued investment by Japanese companies. This positive data provided additional support for the yen.

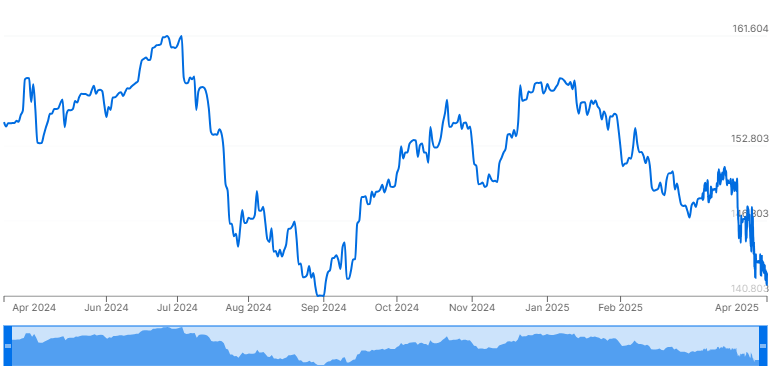

Despite these developments, the market remains cautious. The USD/JPY pair is hovering around the 143 level, with traders awaiting further economic indicators and developments in U.S. trade policies.

Expected Range for USD/JPY: 142.00 – 144.50

Note: This information does not guarantee profits. Please make your own decisions when trading.