Yesterday, global stock markets rose, leading to a risk-on mood. As a result, investors sold the Japanese yen, and USD/JPY remained strong.

During the New York session, Federal Reserve Chair Powell gave his testimony to Congress. However, his comments followed the aggressive stance from the previous Federal Open Market Committee (FOMC) meeting, so there were no surprises for the market.

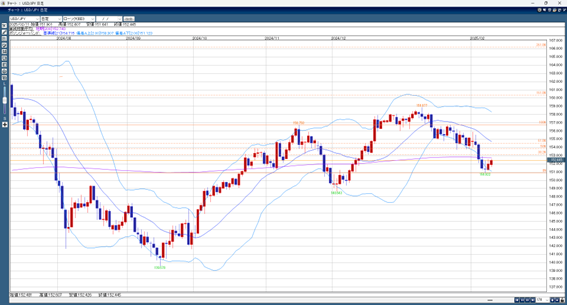

If today’s U.S. Consumer Price Index (CPI) shows that inflation is still rising, it will support Powell’s statements. U.S. long-term interest rates have already increased, and USD/JPY may temporarily rise above 152.70, where the 200-day moving average is located. However, political pressure from President Trump could increase again, limiting the dollar’s rise.

On the other hand, if the CPI report shows that inflation is slowing down, the dollar may weaken significantly.

Expected USD/JPY Price Range: 153.00 – 151.00

Note: The information above does not guarantee any profits. Please make your own decisions when trading.