After the next Treasury Secretary, Bessen, mentioned a plan to raise tariffs by 2.5% in stages, the US dollar recovered from the “Deep Seek” shock and became stronger. The USD/JPY rate went up to 155.97 yen. Later, it dropped to 155.05 yen because US long-term interest rates fell. However, with the FOMC meeting coming tomorrow, traders adjusted their positions, keeping the price stable.

Most experts expect the FOMC to keep interest rates the same. The focus will be on what Chairman Powell says.

If Powell shows that the Federal Reserve (FRB) can stay independent despite pressure from former President Trump to cut interest rates, the US dollar may become stronger. However, Trump’s pressure is strong, so an interest rate cut may happen earlier than expected.

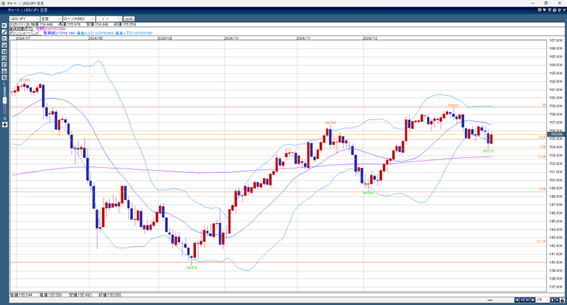

Expected USD/JPY Range: 156.20 yen – 153.70 yen (50%)

Note: The above is not a guarantee of profit. Make your own decisions when trading.