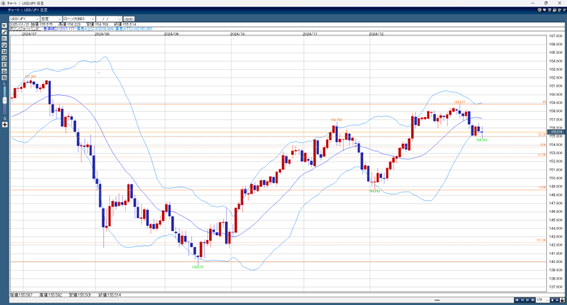

President Trump decided not to apply tariffs on the first day, but during Tokyo trading hours, news reported that he is considering a 25% tariff on Canada and Mexico. This caused the U.S. dollar to rise, with USD/JPY reaching 156.22 yen before falling back to the 154-yen range. Later, in the European market, the dollar rose again to 156.02 yen but did not exceed Tokyo’s high and closed in the low 155-yen range.

The market is moving based on President Trump’s statements, making the direction unclear. However, concerns about inflation have eased compared to earlier, which is limiting the dollar’s rise. Tomorrow, attention will shift to the Bank of Japan’s meeting, where some expect a 0.5% rate hike. If this happens, further downward pressure on USD/JPY is expected. However, if the rate hike is delayed until summer or later, the yen could weaken again in the meantime.

USD/JPY Forecast Range: 156.00–155.00 yen

Note: The above content is not a guarantee of profit. Make trading decisions based on your own judgment.