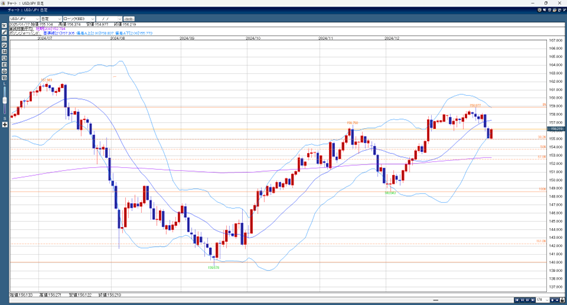

Last week, the USD/JPY fell from the low 158 yen range to below 155 yen, dropping over 3 yen. This was due to strong comments from the Bank of Japan (BOJ) Governor and Deputy Governor, which increased the likelihood of a rate hike this week. On the weekend, an article in the Nikkei newspaper reported that most BOJ committee members support a rate hike. However, since this expectation was already priced into the market, the yen weakened as traders bought back the dollar.

If the BOJ does raise rates at this week’s meeting, the initial reaction is expected to be selling of USD/JPY. However, the BOJ will likely consider the uncertainties surrounding the Trump administration before deciding on future rate hikes. This could limit further drops in the USD/JPY. On the other hand, concerns about the Trump administration’s policies could lead to yen buying as a safe haven, and this may also limit USD/JPY’s rise.

Today’s USD/JPY Forecast Range: 156.70–155.80

This Week’s USD/JPY Forecast Range: 157.50–153.80

Note: The above content does not guarantee profits. Please make your own decisions when trading.