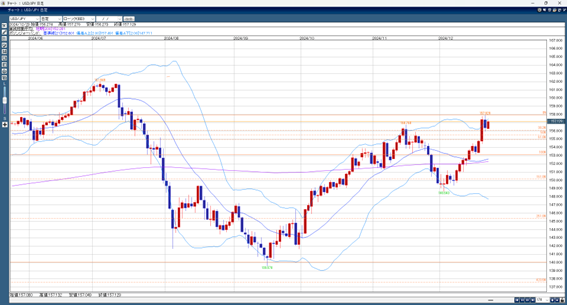

Yesterday, during the Tokyo market opening, USD/JPY rose to 156.69 as buying demand at the daily exchange rate fixing led the market. After that, the price temporarily fell, but in the European market, the selling of the Euro caused overall buying of the Dollar, pushing USD/JPY higher.

In the New York market, U.S. long-term interest rates increased, and USD/JPY rose to 157.27, recovering most of the losses from last week. The sentiment from last week’s central bank meetings— compromising remarks from the Bank of Japan and aggressive remarks from the Federal Reserve—reduced concerns about narrowing U.S.-Japan interest rate differentials, continuing into this week.

As the Christmas holidays start tomorrow, the adjustment phase appears to be over, and price movements are expected to narrow. However, caution is needed as USD/JPY approaches the upper 157 yen range, where last week’s remarks about controlling the weaker yen were made. In the current thin trading conditions, any further statements or actions could cause a sudden drop.

Forecast range for USD/JPY: 157.50 to 156.00

Note: The information above does not guarantee profits. Make your own decisions when trading.