Last week, the U.S. Federal Reserve’s meeting showed a aggressive stance, causing long-term U.S. interest rates to rise. As the weekend approached and the Christmas holiday drew near, there was overall adjustment in the market, leading to gold being bought back.

This week, the market is expected to become quieter due to the Christmas holiday. However, with long-term U.S. interest rates likely to remain high, gold’s price is expected to face resistance in going up. Additionally, as the market will be less active during the holiday, there is a possibility of intensified conflict between Russia and Ukraine. This increases the risk of gold being bought due to geopolitical concerns.

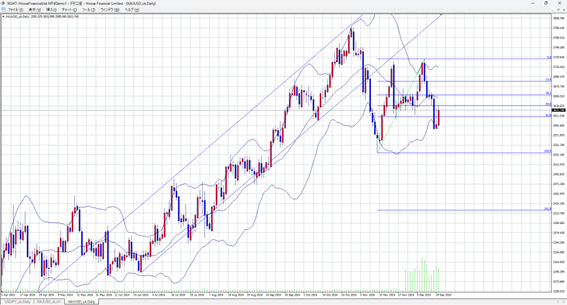

Last week, it was confirmed again that gold prices face resistance, as they fell below the neckline of a double-top pattern. The next support level is around the low reached on November 14, near 2,537.

Gold-Dollar Forecast Range This Week: 2,650–2,540

Note: The above content does not guarantee profits. Please make your own decisions when trading.