Last week, the U.S. dollar rose because the Federal Reserve’s interest rate outlook for next year suggested fewer rate cuts. The Bank of Japan’s stance caused the yen to weaken, pushing the USD/JPY pair up by nearly 5 yen. However, by the weekend, comments from Japan aimed at controlling the yen’s weakness caused the pair to drop by 2 yen.

This week, most markets will be closed for Christmas, but Japan’s market will remain open. Since there wasn’t much adjustment of positions ahead of the holiday, it seems the market is leaning toward long-dollar and short-yen positions.

Bank of Japan Governor Ueda is scheduled to speak this week, and attention will focus on whether he mentions yen weakness related to rising prices. Additionally, the U.S. debt ceiling issue and statements from former President Trump could easily lead to dollar selling, so there is a risk of the USD/JPY pair moving lower.

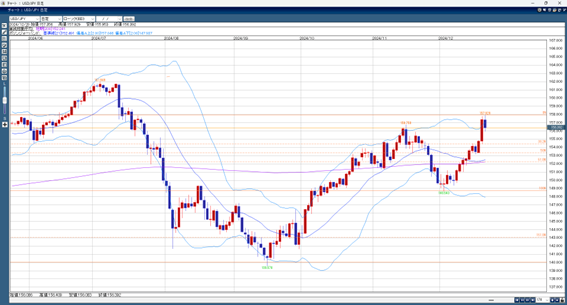

However, the pair avoided a dead cross between the 200-day moving average and the Bollinger Band’s central line. This makes the 152-yen range a strong support level.

Today’s USD/JPY Forecast Range: 156.80–155.50

This Week’s USD/JPY Forecast Range: 157.00–153.30

Note: The above content does not guarantee profits. Please make your own decisions when trading.