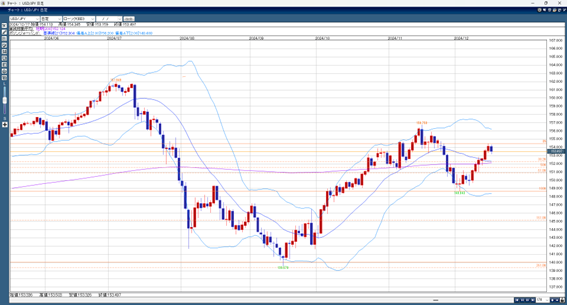

Ahead of the FOMC meeting held early tomorrow, there was general yen buying yesterday, causing the USD/JPY to fall from around 154 yen to the low 153 yen range. However, since December, the exchange rate has been at a level where the dollar is stronger and the yen is weaker.

A 0.25% rate cut is already priced in, and the market is focused on the number of rate cuts expected next year, the terminal rate, and Chairman Powell’s comments. Due to concerns over U.S. economic indicators, the next Trump administration, and a possible resurgence of inflation, some believe the Fed may move from rate cuts to rate hikes again, which could support the dollar overall.

However, since the dollar has already risen, even if there is a positive response to the dollar, it may be pushed back once the Bank of Japan’s meeting is ahead. On the other hand, if an outcome is expected, the price may fall initially but is likely to be bought back after testing lower levels.

To determine the direction of the USD/JPY, it seems best to wait until both the U.S. and Japan’s results are clear.

USD/JPY Expected Range: 156.20 (upper Bollinger Band) – 152.20

Note: The above content does not guarantee profits. Please make your own decisions when trading.