While people expect the Bank of Japan (BOJ) to keep interest rates unchanged, CAD/JPY (Canadian dollar-yen) remains stable. However, the Canadian dollar has been weak against the U.S. dollar, falling for almost three months. This is because Canada’s central bank, the Bank of Canada (BOC), has been cutting interest rates. Last week, they lowered rates for the fifth time, showing a strong easing policy.

Today, Canada’s November CPI (Consumer Price Index) will be announced, and it is expected to decrease compared to the previous month. If the data meets expectations, it may create more room for interest rate cuts in Canada, which could weaken the Canadian dollar further.

Against the yen, CAD/JPY is expected to remain stable. However, since the BOJ may still decide to raise interest rates, the Canadian dollar could weaken slightly before the announcement.

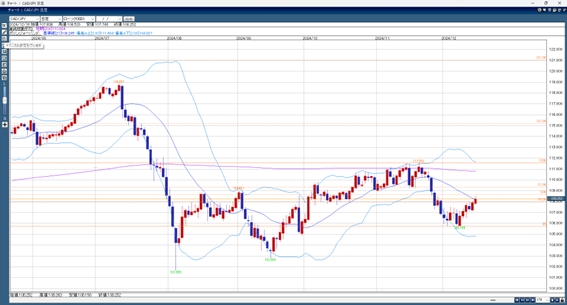

CAD/JPY Expected Range: 108.60 – 107.80

Note: The above content does not guarantee profits. Please make your own decisions when trading.