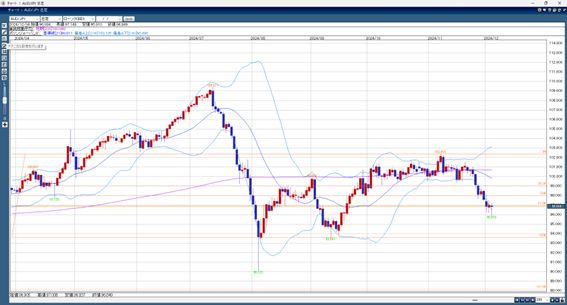

With the unrest caused by South Korea’s emergency situation calming down, risk-off sentiment eased. In the Tokyo market, the AUD/JPY (Australian Dollar/Japanese Yen) pair saw early buying and rose to 97.14. However, Australia’s GDP for July-September was announced at 0.8%, falling short of the expected 1.1%, causing the pair to drop to 95.92.

Expectations that the Reserve Bank of Australia (RBA) will delay rate cuts increased the selling pressure on the Australian dollar. Later, as stock markets in the U.S., Europe, and Japan rose, risk-on sentiment pushed the yen weaker, bringing AUD/JPY back to the 97 level.

While the RBA is not expected to cut rates soon, this highlights the potential for further drops in the Australian dollar. Additionally, ongoing geopolitical risks, including tensions in South Korea, keep the downside risk for AUD/JPY in play.

AUD/JPY Expected Range: 97.20–95.60

Note: The information provided does not guarantee profits. Please make your own decisions when trading.