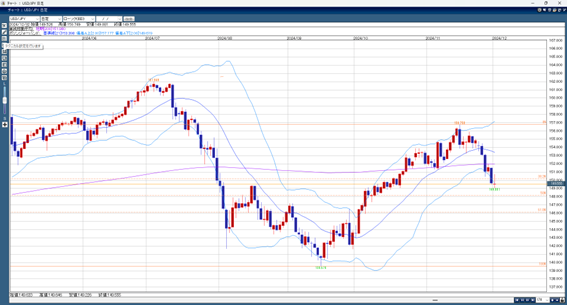

At the start of the Tokyo market this week, U.S. long-term interest rates rose, causing the dollar-yen pair to climb by over 1 yen, from around 149.50 to 150.74. After that, profit-taking sales pushed the pair back down to around 150.

In the New York market, cross-yen pairs weakened across the board. Market attention focused on differences in monetary policy, with some expecting interest rate hikes from the Bank of Japan compared to interest rate cuts in Europe and the U.S. The dollar-yen pair fell below the Tokyo low, triggering stop-loss selling and dropping to 149.09. Due to thin trading, price movements were larger than usual.

Today’s JOLTS report (job openings data) could affect the dollar. If the data leads to further selling, the dollar-yen pair might drop below today’s low, possibly resulting in a sharper decline.

Predicted Dollar-Yen Range: 150.20–148.20

Note: The above content does not guarantee profits. Please make your own decisions when trading.