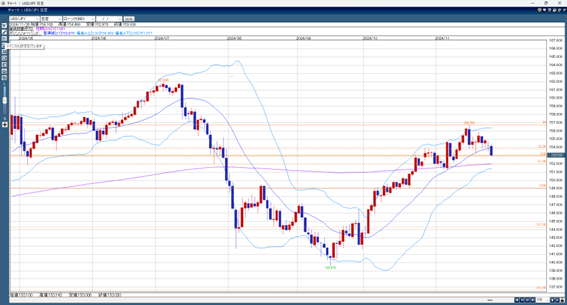

Early in the Tokyo trading session, Trump announced tariffs on China, Canada, and Mexico. This caused the dollar to strengthen, pushing USD/JPY up to 154.49. However, selling in cross-yen pairs increased yen buying, causing USD/JPY to drop to 153.55. Later, it recovered to 154.20, but dollar selling, especially against the euro, pushed USD/JPY below Tokyo’s low. This triggered stop-loss orders, taking it down to 152.98.

In the New York session, weak U.S. economic data was released, but since the dollar had already been sold off, the dollar rebounded. However, with the U.S. Thanksgiving holiday approaching, traders adjusted their positions, and both USD/JPY and cross-yen pairs struggled to rise further.

With lower market liquidity, today’s U.S. PCE deflator data could lead to stronger dollar buying. However, it is expected that USD/JPY may face selling pressure as it has been overbought.

USD/JPY Forecast Range: 153.80–152.00

Note: The above content does not guarantee profits. Please make your own decisions when trading.