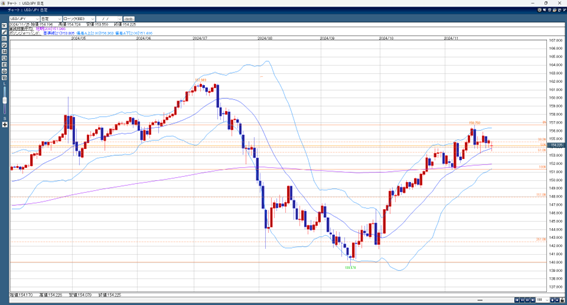

On Monday, the Tokyo market started with selling pressure on USD/JPY. Over the weekend, reports suggested that Scott Bessent, who is expected to focus on fiscal discipline, might be nominated as the next U.S. Treasury Secretary. This eased concerns about a rapid increase in the fiscal deficit, causing USD/JPY to drop to 153.56 yen.

Later, the pair recovered to the high 145-yen range but fell again to 153.63 yen after news of a potential ceasefire agreement between Israel and Lebanon.

Following this, Bessent made statements about implementing various tax cuts and maintaining the U.S. dollar’s position as a global reserve currency. This pushed USD/JPY back up to around 154.50 yen.

The market has been volatile, moving up and down significantly. U.S. long-term interest rates have also dropped to 4.26%, a 0.15% decrease from last week, which seems to have reduced excessive buying of the dollar.

With Thanksgiving this week, fewer traders are expected in the market, which could keep the movements volatile. Overall, the dollar is likely to face resistance and struggle to rise much higher.

USD/JPY Expected Range: 154.70 yen–153.40 yen

Note: The above information does not guarantee profits. Please make your own decisions when trading.