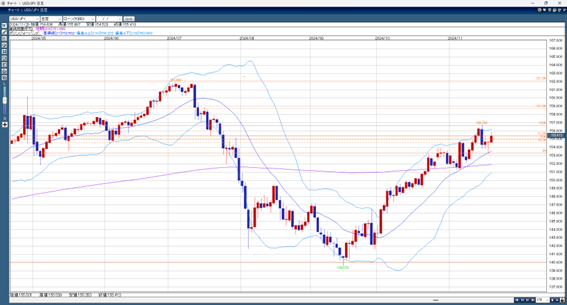

In the Tokyo market, the USD/JPY rate rose due to dollar buying triggered by the Gotobi day (a day when companies typically settle payments, increasing dollar demand). Later, in the European market, the dollar strengthened further, supported by rising U.S. long-term interest rates, pushing USD/JPY to 155.88 yen.

However, during the New York session, news broke that Ukraine had fired a UK-made cruise missile at Russia. This raised geopolitical risks again, leading to yen buying. As a result, USD/JPY fell back to 155.06 yen.

Despite this, the dollar remained supported by expectations that the Federal Reserve (FRB) would not lower interest rates soon. This kept the dollar strong overall.

Geopolitical risks are usually temporary and settle over time. Meanwhile, the dollar’s strength, driven by reduced expectations for interest rate cuts, is likely to continue. Therefore, USD/JPY is expected to test the 156-yen level. However, caution about possible market intervention at this level could limit any sharp rise.

USD/JPY Predicted Range: 156.00 yen – 155.00 yen

Note: The above content does not guarantee profits. Please make your own decisions when trading.