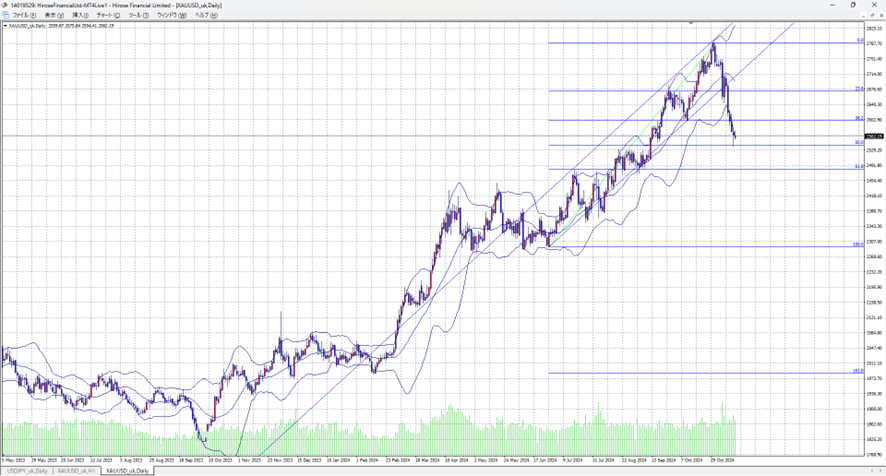

Last week, the strong dollar, fueled by the ‘Trump Rally,’ pushed gold prices lower. Additionally, Federal Reserve Chairman Powell’s hawkish comments—stating that the economy does not currently require urgent rate cuts—caused the likelihood of a December rate cut to decrease. This drove the dollar higher, resulting in gold prices falling to 2,537. By the weekend, gold recovered slightly to 2,575, but the rebound was limited, indicating that selling pressure remains strong.

Although the Trump Rally’s impact on the dollar is nearing its end, the retreat of rate cut expectations and strong U.S. economic indicators suggest the dollar will continue to stay firm. The next support level for gold is around 2,480, based on the 61.8% Fibonacci retracement and the level where gold found support from August to September.

Gold-Dollar Predicted Range: 2,600–2,480 (61.8%)

※Note: The above content does not guarantee profits. Please make your own decisions when trading.