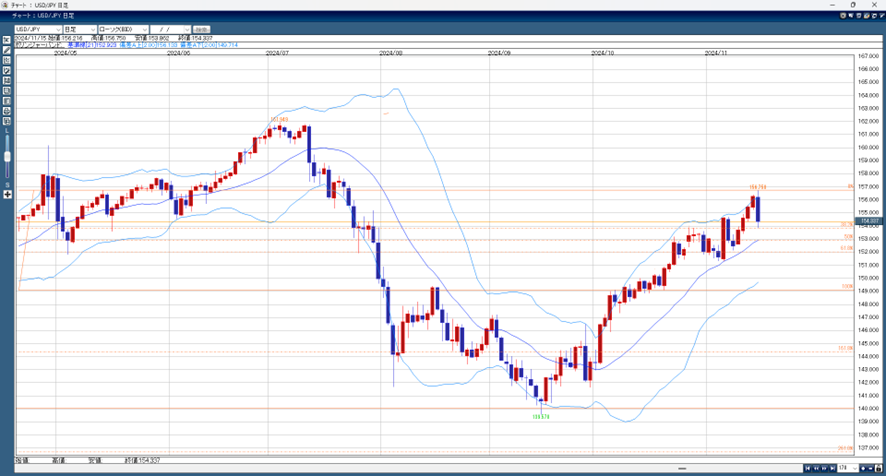

Last week, the momentum from the ‘Trump Rally’ continued. The USD/JPY started in the mid-152 range and broke through the strong resistance level of 155. This increase happened without any verbal intervention from authorities. Following Federal Reserve Chairman Powell’s hawkish remarks, which lowered the probability of a December rate cut, U.S. long-term interest rates rose, pushing the USD/JPY up to 156.75. However, by the weekend, selling pressure brought the pair back to the high 153 range, partly due to selling in cross-yen pairs, which added downward pressure on the USD/JPY.

This week, the buying pressure on the dollar from the Trump Rally seems likely to fade. However, expectations for a Federal Reserve rate cut have diminished as strong U.S. economic data reduce the need for cuts. If economic indicators continue to show strength, the dollar is expected to remain firm.

That said, since the news on November 6 showing Trump’s lead, the USD/JPY has risen sharply, increasing by over 5 yen and 40 sen in a short time. Such rapid increases could lead to intervention, but the market may continue testing higher levels until concrete action is taken.

Today’s USD/JPY Predicted Range: 155.00–153.80

This Week’s USD/JPY Predicted Range: 158.00–152.80 (50%, Bollinger Band baseline)

※Note: The above content does not guarantee profits. Please make your own decisions when trading.