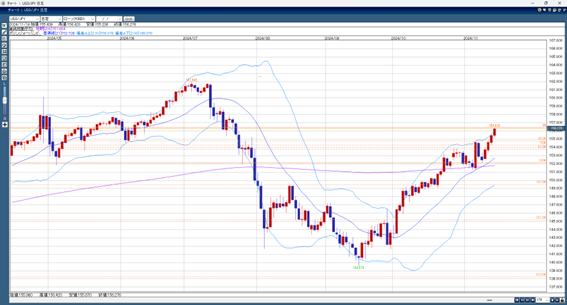

In the early morning Tokyo market, the USD/JPY pair started around 155.24 and rose to 156.13, driven by strong dollar buying. Despite this increase, there was no verbal intervention from authorities. Some selling occurred around the 156 level, but in the European market, dollar buying continued, especially against the Euro and Pound. This pushed USD/JPY even higher, reaching 156.24, surpassing Tokyo’s earlier high.

Ahead of the New York market, it was pushed back down to the 155 range. However, after the U.S. PPI data came in stronger than expected, USD/JPY was again pushed up to the 156 level. Later, as Federal Reserve Chair Powell made hawkish comments, saying ‘there’s no urgent need for a rate cut,’ the dollar strengthened further across the board. USD/JPY reached a high of 156.42 before the market closed.

Last week, the 21-day Moving Average (MA) moved above the 200-day MA, a sign to buy, and this helped USD/JPY break through the previous resistance at 155. The next resistance level is the year’s high of 161.94, reached in July, with no strong resistance in between. Still, the lack of any verbal intervention at this stage feels a bit ominous.

USD/JPY Predicted Range: 155.00 – 157.00

Please note that the above information does not guarantee profits. Make trading decisions at your own discretion.