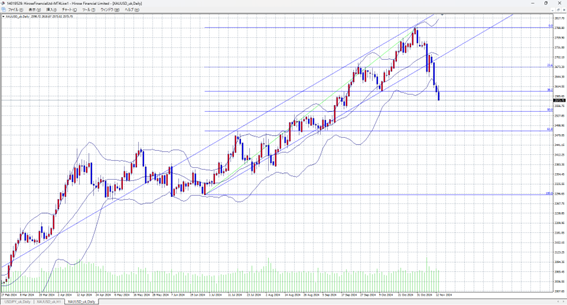

Ahead of the U.S. CPI announcement, gold prices rose to around 2620 as buyers adjusted positions. The U.S. October CPI rose as expected, from 2.4% to 2.6% compared to the previous month. Since this increase was already anticipated, gold initially saw some buying. However, as U.S. long-term interest rates rose, the demand for the dollar strengthened, leading gold prices to decline.

In the NY market, all three major stock indexes dropped, and with long-term U.S. interest rates around 4.45%, selling pressure on gold continued. Gold prices ultimately closed lower, falling below 2580.

With Republicans gaining a majority in both the U.S. Senate and House, it is now seen as easier for Trump’s policies to be passed. This is expected to slow down the pace of rate cuts by the Federal Reserve. As a result, the dollar’s strength continues, and the selling pressure on gold persists.

Gold and Dollar Forecast Range: 2585–2540

Note: The above information does not guarantee profits. Please make trades based on your own judgment.