Yesterday in the Tokyo market, despite a major drop in the Nikkei stock index, the USD/JPY pair broke above the immediate resistance level of 155 yen. No warnings or comments from officials were heard regarding this.

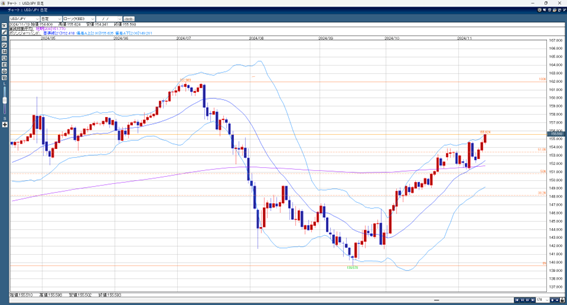

The U.S. CPI announced that day rose as expected, but since this was already anticipated, USD/JPY dropped to 154.35 yen immediately after the announcement. However, the rise in U.S. long-term interest rates kept strong demand for the dollar, and as buying resumed, USD/JPY was pushed back to the 155-yen level. News also came out that Republicans won a majority in the U.S. House, making it easier for Trump’s policies to pass in the future, which supported more dollar buying, pushing USD/JPY to 155.60 yen. This level aligns with the 76.4% Fibonacci retracement, making it a significant level.

With signs of a second round of dollar buying, USD/JPY is expected to test the 156-yen level. Up to this point, there has been no verbal intervention from Japan, and the market seems to be pressuring officials to take action.

USD/JPY Forecast Range: 156.00–154.80 yen

Note: The above information does not guarantee profits. Please make trades based on your own judgment.