In the Tokyo market, the Yen started stronger, and the USD/JPY dropped to 149.09. However, later, U.S. long-term interest rates rose, pushing USD/JPY above 150 yen in the European market. This was likely due to a well-known economist suggesting that the U.S. Federal Reserve (FOMC) might not cut interest rates in their meeting next month.

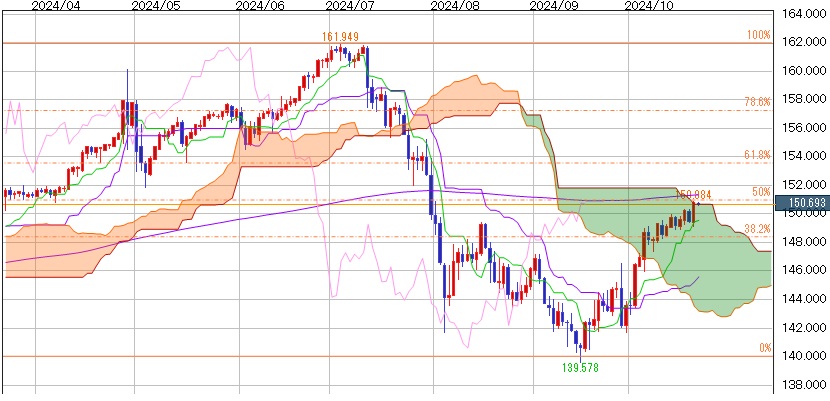

When the New York market opened, selling pressure increased, especially on the Euro and the British Pound, causing USD/JPY to rise further. It broke past last week’s high of 150.32 and reached 150.88, finishing above the upper limit of the Ichimoku cloud (a technical indicator).

The weekend’s Japanese House of Representatives election showed the ruling Liberal Democratic Party struggling, which may have influenced the Bank of Japan’s decisions on interest rates. This contributed to the Yen weakening. Some believe political instability might make it harder for the government to intervene in the currency market, increasing the chance of USD/JPY going higher.

The next target is around 151.30 yen, where the 200-day moving average (200MA) is located.

Predicted USD/JPY range: 151.30 yen to 150.20 yen

Please note that the above information does not guarantee profits, and you should make trading decisions at your own discretion.