Yesterday, the NZD/JPY pair started the week with selling pressure in the Oceania market. Disappointment over China’s insufficient financial support measures led to stronger selling, causing the pair to drop below 91 yen. However, as European and U.S. stock markets performed well, risk-on buying increased, and the rate recovered to the low 91-yen range by the end of the day.

Tomorrow morning, the New Zealand Q3 CPI (Consumer Price Index) is expected to be revised down from 3.3% to 2.2%. If this happens, many expect a 0.5% rate cut at the next RBNZ (Reserve Bank of New Zealand) meeting, which could lead to more selling of the NZ dollar. However, since the RBNZ already made a 0.5% rate cut last week, the market may have already factored in this CPI prediction, so the downside could be limited.

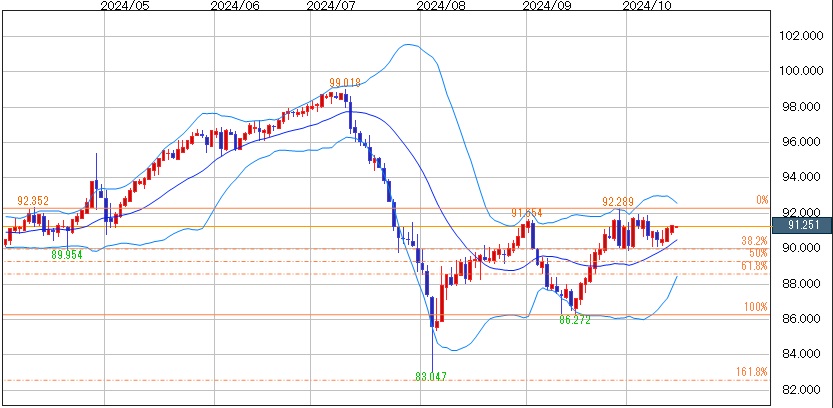

Expected NZD/JPY range: 92 yen to 90 yen (38.2%)

Please note that this content does not guarantee profits. Make trading decisions based on your own judgment.