Last week, Canada’s September employment report showed strong results, with an increase in the number of employed people and a decrease in the unemployment rate. As a result, the CAD/JPY rate rose to 108.60 yen after the report was released. Although the Canadian dollar had been falling due to expectations of a Bank of Canada (BOC) rate cut, some buying back occurred. However, the upcoming CPI (Consumer Price Index) report this week prevented further rise.

The Canada September CPI, which will be released this week, dropped to the target of 2% last month, and it is expected to decrease further to 1.9% this time. If the prediction is correct, there is a possibility of more rate cuts by the BOC, which could lead to a larger decline in the Canadian dollar.

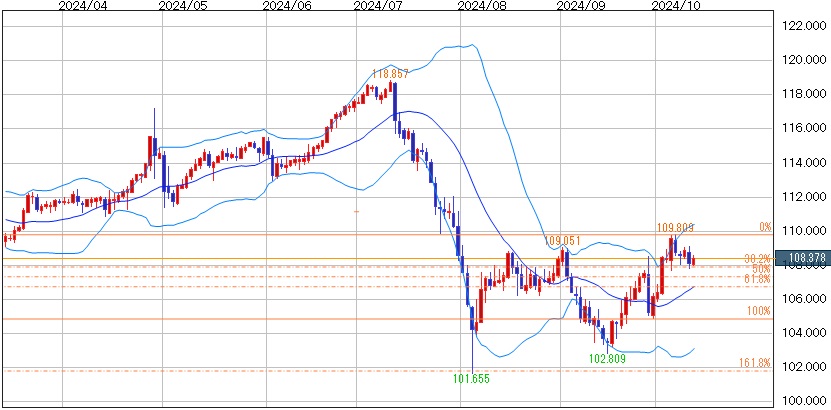

This week’s CAD/JPY forecast range: 108.60 yen to 106.80 yen (61.8% retracement, BB benchmark)

Please note that the above information does not guarantee any profit. Please make your own decisions when trading.