At the Reserve Bank of New Zealand (RBNZ) policy meeting this week, it is expected that the interest rate will be cut from 5.25% to 4.75%, a 0.5% reduction. Many financial institutions are already predicting this cut, so the market has mostly prepared for it. Even if the RBNZ does cut the rate by 0.5%, the NZ dollar might attract buying when it falls, presenting a short-term opportunity for buyers. However, in the previous meeting, the RBNZ lowered inflation expectations for one and two years ahead and predicted interest rates would fall to 3.85% by 2025. If the RBNZ continues to lower rates, there may be limited room for the NZ dollar to rise.

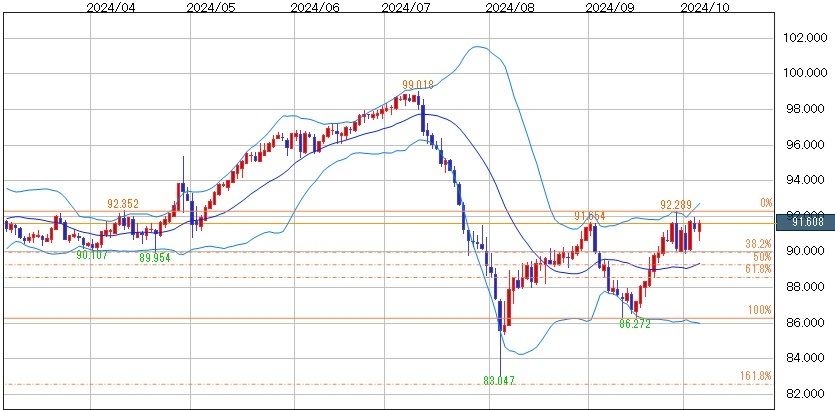

This week’s expected range for NZD/JPY: 92.80 yen (upper limit of the Bollinger Bands) to 90.00 yen (38.2% level).

Please note that this information does not guarantee profits, so make your own decisions when trading.