At the end of last week during Tokyo trading hours, Tokyo-area inflation data showed the fastest growth in three months, surpassing expectations. This led to overall yen strengthening. Additionally, Bank of Japan Governor Ueda hinted at the possibility of an interest rate hike in December, which further boosted the yen.

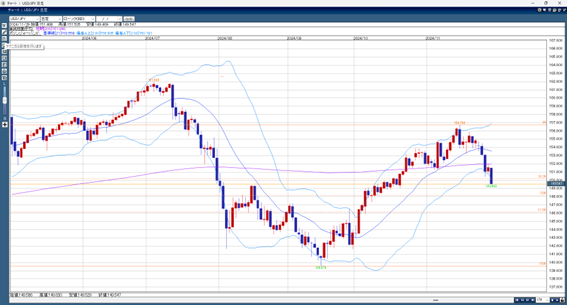

At the same time, a meeting between former U.S. President Trump and Mexico’s president raised the likelihood of tariff exemptions. This reduced fears of extreme trade restrictions on other countries, leading to stronger selling pressure on the dollar. As a result, the USD/JPY dropped by over 5 yen throughout the week, falling below the 200-day moving average.

With the U.S. Thanksgiving holiday, market liquidity decreased, making it easier for prices to move sharply in one direction. This trend is expected to continue this week.

As downward pressure on the dollar increases, the release of U.S. employment data and the ISM index this week could push USD/JPY even lower depending on the results.

Today’s USD/JPY Forecast Range: 150.50–149.00

This Week’s USD/JPY Forecast Range: 152.00 –148.20

Note: The above content does not guarantee profits. Please make your own decisions when trading.