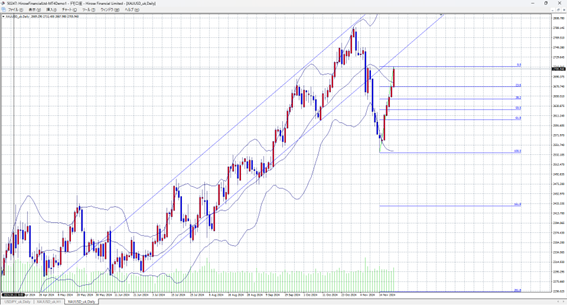

After the U.S. dollar started to strengthen with the ‘Trump Trade’ on November 6, last week’s gold prices returned to around the previous high of 2710. On November 18, reports that the U.S. allowed Ukrainian forces to use American weapons against Russia triggered risk-averse buying of gold. This was followed by heightened geopolitical risks, such as Russia approving its nuclear doctrine and launching ballistic missiles. These events pushed gold back to levels seen before the drop, creating a V-shaped recovery.

For now, the wave of buying seems to have settled, and this week we may see some selling as part of market adjustments. In particular, due to the U.S. Thanksgiving holiday, many people will take long vacations, reducing the number of market participants and making it easier for positions to be adjusted. However, because geopolitical risks remain, any drop in gold prices is expected to be limited.

If gold surpasses 2710 and breaks through the lower boundary of the upward trend channel, the upward trend in gold prices may resume. This will be something to watch closely.

This Week’s Predicted Gold-Dollar Range: 2730–2644

Please note: The above content does not guarantee profit. Please make your own decisions when trading.