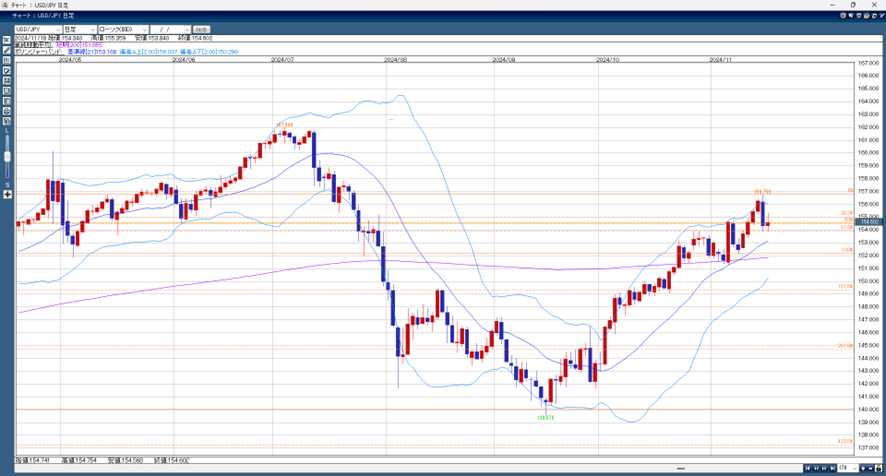

At the start of the Tokyo market this week, USD/JPY rose to 154.74 yen, continuing last week’s dollar-buying trend. However, ahead of BOJ Governor Ueda’s speech, it dropped to 153.85 yen on speculation about potential rate hikes.

When the Governor’s speech provided no new information, disappointment-led buying pushed USD/JPY to 155.14 yen. Later, falling stock prices slowed its rise. During the NY session, rising U.S. long-term interest rates lifted USD/JPY to 155.35 yen, but as rates declined, the dollar weakened, and USD/JPY fell back to around 154.50 yen by the close.

USD/JPY remains tied to U.S. long-term interest rates. Dollar buying continues due to inflation concerns under Trump’s administration and Powell’s hawkish stance, while BOJ’s slow rate hikes provide support.

Forecast Range: 155.10 yen – 153.90 yen

※Note: The above content is not a guarantee of profit. Please make your own trading decisions when trading.