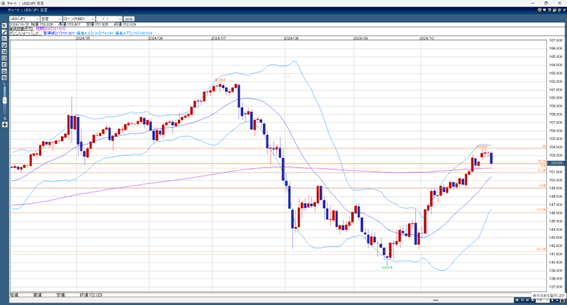

The Bank of Japan (BOJ) removed the phrase ‘ample time’ from its statement, signaling a firmer stance on raising rates. After hitting a high of 153.60 yen, the USD/JPY fell to 151.93 yen. Although it was later bought back up to 153.05 yen, it dropped again to 151.84 yen when stock prices fell on the NY market, closing at nearly the day’s low. Since the yen has weakened by almost 10 yen since October, this recent decline likely reflects concern about the yen’s weakening. The yen has not only been bought against the dollar but also against other currencies, suggesting USD/JPY may have reached a peak for now.

As it’s near the weekend, the outcome of today’s US employment report could lead to more USD/JPY buying. However, next week’s FOMC meeting and the upcoming presidential election may have little impact on yen-buying trends, and any further rise in USD/JPY might be limited.

USD/JPY Forecast Range: 153.00 yen – 151.50 yen

Note: This information does not guarantee profit. Please make trading decisions based on your own judgment.