Other Information – Social Trading for SUBscription

This section provides answers to the most common questions from Followers using the Hirose Social Trading platform. It’s designed to help you understand how to subscribe to Providers, manage your Copy Trading accounts, monitor performance, and handle fees effectively. Before contacting support, please review this section — you may find quick solutions and helpful tips for operating as a Follower.

1.Who can become a Follower?

Answer: Any Hirose customer with a trading account can apply to become a Follower through the Social Trading system.

Answer: Any Hirose customer with a trading account can apply to become a Follower through the Social Trading system.

2.What does copy trading mean?

Answer: As the name suggests, it means copying someone’s trades. With this approach, a Forex platform user subscribes to one or more successful traders and repeats their deals at exactly the same time. Traders, in their turn, receive a commission for sharing their experience and ideas.

Answer: As the name suggests, it means copying someone’s trades. With this approach, a Forex platform user subscribes to one or more successful traders and repeats their deals at exactly the same time. Traders, in their turn, receive a commission for sharing their experience and ideas.

3.What is copy trading in Forex?

Answer: This means Forex platform users subscribe to successful traders who operate foreign exchange stocks, futures, commodities and CFDs. Deals are opened and closed by analogy with famous traders, and the latter receive a fee for sharing their signals. That enables beginners to reach the same profits as successful market players do.

Answer: This means Forex platform users subscribe to successful traders who operate foreign exchange stocks, futures, commodities and CFDs. Deals are opened and closed by analogy with famous traders, and the latter receive a fee for sharing their signals. That enables beginners to reach the same profits as successful market players do.

4. How does copy trading work?

Answer: A user follows successful traders’ actions in exactly the same manner: opens the same deals at the same time and closes them together with the trader, following his/her signals. When it comes to copy trading, trading can be automated: the platform will execute deals after the followed trader. In copy trading, the user himself is responsible for managing his own deals, and can take into account the signals sent by the traders he’s subscribed to.

Answer: A user follows successful traders’ actions in exactly the same manner: opens the same deals at the same time and closes them together with the trader, following his/her signals. When it comes to copy trading, trading can be automated: the platform will execute deals after the followed trader. In copy trading, the user himself is responsible for managing his own deals, and can take into account the signals sent by the traders he’s subscribed to.

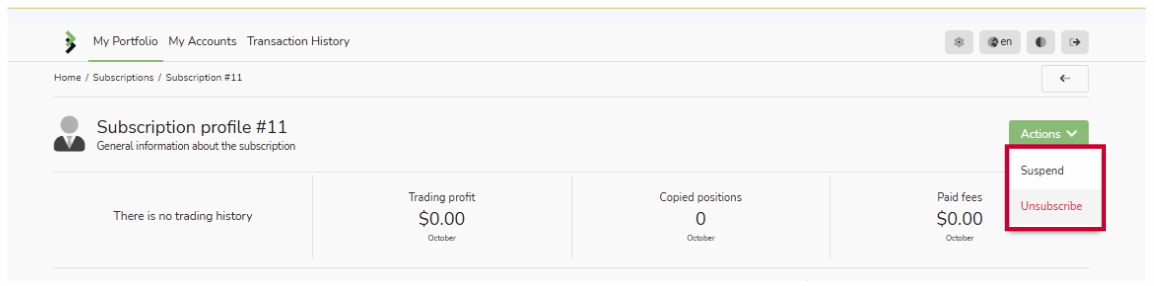

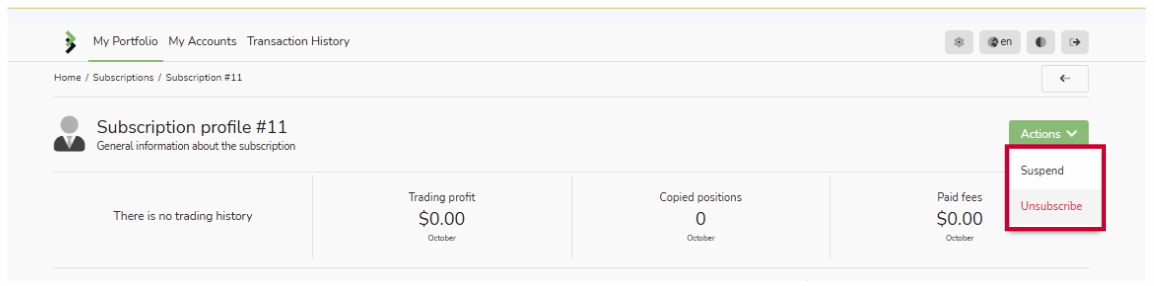

5. Can I unsubscribe from a Provider?

Answer: Yes, you can unsubscribe or suspend your subscription at any time from the Subscription Profile page. Once unsubscribed, new trades will no longer be copied, but any existing open positions may require manual management.

Answer: Yes, you can unsubscribe or suspend your subscription at any time from the Subscription Profile page. Once unsubscribed, new trades will no longer be copied, but any existing open positions may require manual management.

6. Can I adjust my copy trader settings?

Answer: Yes. You can change the copy stop conditions, copying type and account settings at any time.

It’s worth considering the fact that changes don’t apply to open trades and will apply to all future copy-trades.

See more: 13-4 Modify Subscription Settings

Answer: Yes. You can change the copy stop conditions, copying type and account settings at any time.

It’s worth considering the fact that changes don’t apply to open trades and will apply to all future copy-trades.

See more: 13-4 Modify Subscription Settings

7.Can the provider change their commission rate?

Answer: Yes, a trader can change their profit share size at any time, but this change will only apply to new copy traders who have joined in after a new profit percentage is set. All current copy traders will work under the conditions valid at the moment of their attachment.

Answer: Yes, a trader can change their profit share size at any time, but this change will only apply to new copy traders who have joined in after a new profit percentage is set. All current copy traders will work under the conditions valid at the moment of their attachment.

8. Can I copy the trades of different Traders?

Answer: Yes, you can copy as many traders as you wish. Wise distribution of funds will allow you to reach the highest copy trading efficiency. You can customize copy trading settings for each particular trader.

Answer: Yes, you can copy as many traders as you wish. Wise distribution of funds will allow you to reach the highest copy trading efficiency. You can customize copy trading settings for each particular trader.

9.Can I make money from copy trading?

Answer: Yes. As an investor, you can trade profitably by copying the trades of experienced traders. In turn, experienced traders increase their income: in addition to the profit from their trading, they receive a percentage of the profits made by copying investors.

Answer: Yes. As an investor, you can trade profitably by copying the trades of experienced traders. In turn, experienced traders increase their income: in addition to the profit from their trading, they receive a percentage of the profits made by copying investors.

10. Why can copied volumes differ from the provider’s original trade volumes?

Answer: Copied volumes may differ from the provider’s original trade volumes due to the Autoscale settings in the follower’s strategy.

Answer: Copied volumes may differ from the provider’s original trade volumes due to the Autoscale settings in the follower’s strategy.

11. How is copied volume calculated when using Autoscale in Volume Scaling?

Answer: When using Volume Scaling: Autoscale, the copied volume is calculated using the formula:

Copied volume = Provider’s volume × (Follower’s Compared Value / Provider’s Compared Value) × Ratio multiplier

The “Compared Value” can be either Balance or Equity, depending on the strategy settings. The ratio between the follower’s and provider’s account sizes is then multiplied by the Ratio multiplier.

Example: Autoscale sharing case

Subscription Strategy settings:

- Volume scaling: Autoscale

- Compared value: Balance

- Ratio multiplier: 1

- Max open volume: 5

- Action: Scale down

Given:

- Follower’s balance: 10 000 USD

- Provider’s balance: 1 000 USD

- Provider opens trade: buy 1 lot EURUSD

Result:

- Follower copies the trade as: buy 5 lot EURUSD (intended volume by Autoscale: 10 lots, corrected by Max open volume.

If you need assistance with Offer setup, agent settings, fee issues or other assistance, please contact Hirose Support Team via:

👉 https://hiroseag.com/form/contact-us/

👉 https://hiroseag.com/form/contact-us/

Are you ready? Let’s get started!